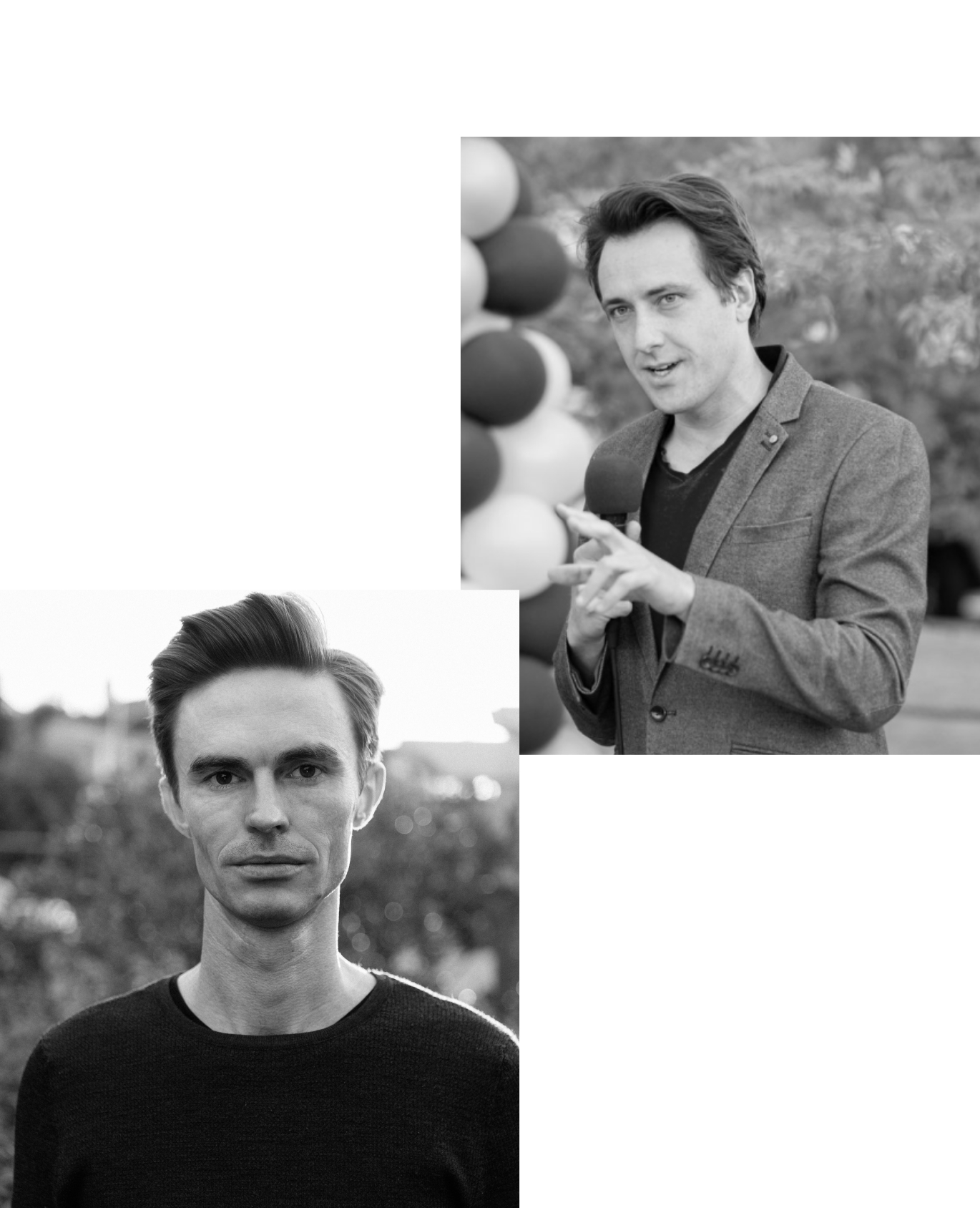

Mat McGann

Founder and CEO, Health Horizon

Creator, Roam for Teamwork

PhD Theoretical Physics

Other projects

Jamie Freestone

Screenwriter and researcher in Canberra

Postdoctoral research fellow at ANU

Podcast maker

Writing a book about science & meaning